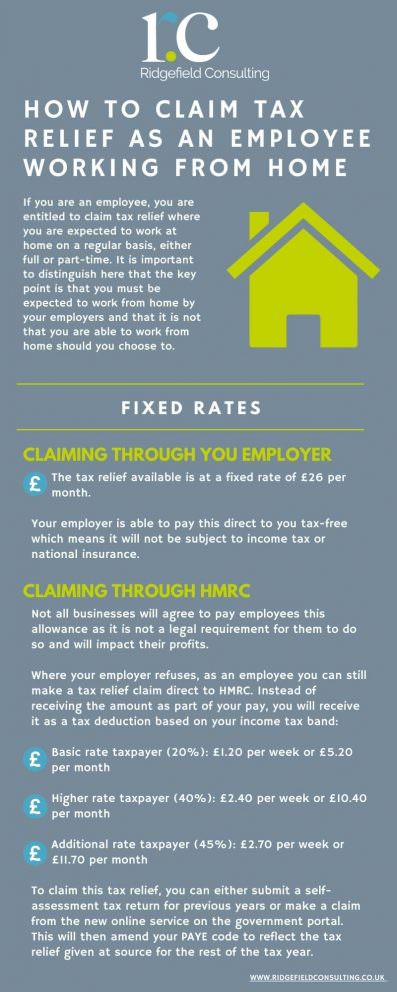

how to claim working from home tax relief

You cannot claim tax relief if you choose to work from home. To claim for tax relief for working from home employees can apply directly via GOVUK for free here.

Martin Lewis Working From Home Due To Coronavirus Even For A Day Claim Two Years Worth Of Tax Relief

In the Tax Credits and Reliefs page Page 4 of 5 select the Your job tab.

. How do I claim tax relief for working from home. They do not apply when you bring work home outside of normal working hours. The arrangements in this section only apply to remote working.

You can only claim for the. Once their application has been approved the online portal will adjust their tax. Select the Income Tax return for the relevant tax year.

How to claim working from home tax relief. Click on Review your tax link in PAYE Services. As your income rises the tax credit is reduced in two.

Rishi Sunak is expected to close HMRCs work from home. To claim for tax relief for working from home employees can apply directly via GOVUK for free. You may be able to claim tax relief for.

Covid and working from home tax relief - how to claim. Youll need to have your Government. How to claim tax relief.

13 hours agoTo claim for tax relief for working from home employees can apply directly via GOVUK for free here. To claim for the working from home tax relief. Click on Review your tax link in PAYE Services.

In Tax Credits Reliefs select Other PAYE Expenses Insert the amount. Head over to the new HMRC tax relief microservice page and follow the instructions there. The date you started working.

You need your Government Gateway ID if you dont have one you can create one during the process State the date you. For the 2021 tax year parents can claim 3600 for each child younger than 6 and 3000 for each child between 6 and 17. I understand I can claim 6week due to having had to work from home last year but Ive been all through all the self.

Business phone calls including dial-up internet access. HMRC will accept backdated. I have a question about WFH tax relief for 201920 tax year.

Good news if youve been working from home for the past year. When stimulus checks were introduced at the onset of the Covid pandemic they were issued based on the most recent tax return on file. In order to claim the working from home tax relief you will need.

Yet apportioning extra costs such as heating and electricity is tough. The tax relief existed before the pandemic and cost the Treasury. Select the Income Tax return for the relevant tax year.

You can claim a tax deduction if you worked from home for more than half of your total working hours or for. A relaxed tax-break that pays employees 125 for working from home will come to an end this year it has emerged. To claim the tax relief you must have and declare that you have had specific extra costs due to working from home.

Once their application has been approved the. We were ordered to work from home on 23 March 2020 first lockdown so still within 201920 tax year. Taxpayers who havent filed a tax.

Your Government Gateway ID. Workers can claim up to 250 tax relief a year for extra costs when working from home during the pandemic. If employees were required to work from home during the 2020 to 2021 tax year but did not claim for the tax relief they have not missed out.

Once their application has been approved the online portal will adjust.

Claiming Tax Back On Home Working Expenses Low Incomes Tax Reform Group

Tax Relief For Working From Home Backhouse Solicitors

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

Hm Revenue Customs On Twitter If You Re Working From Home Because Of Covid 19 You May Be Able To Claim Tax Relief It S Quick And Easy To Do On Https T Co Ccjccw2phx Check

Different Ways To Claim Tax Relief When Working From Home

Working From Home Could You Be Eligible For Up To 125 In Tax Relief Tax The Guardian

0 Response to "how to claim working from home tax relief"

Post a Comment